Igor Kutyaev/iStock by way of Getty Pictures

Monetary inventory positive factors had been among the many strongest in U.S. buying and selling on Wednesday as traders noticed a glimmer of hope for negotiations between Ukraine and Russia. The optimism gave traders the braveness to edge away from protected havens of Treasurys, pushing up their yields, a superb omen for banks and the financial system typically.

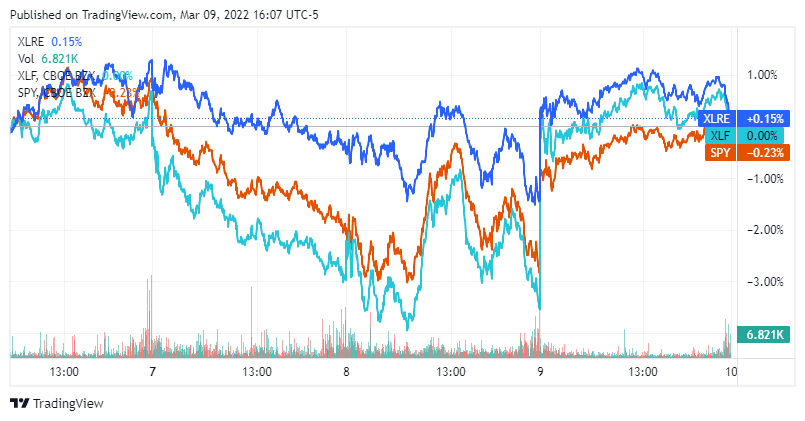

The Monetary Choose Sector SPDR ETF (NYSEARCA:XLF) gained 3.6%, the ETF’s largest acquire in a yr, on Wednesday. Actual property shares additionally superior, which regularly happens when traders are nervous and search a protected funding. The Actual Property Choose Sector SPDR ETF (NYSEARCA:XLRE) rose 1.6%. Rita Mkrtchyan, senior finance and litigation legal professional at Oak View Regulation Group in Burbank, California, says that monetary and actual property shares aren’t immediately correlated however have overlapped on account of current international occasions.

“The final notion is that the world shouldn’t be as protected as we thought,” Mkrtchyan stated in an e-mail to In search of Alpha. “When individuals view the world as getting riskier, they save extra. In impact, actual property continues to be the prime asset of option to safeguard principal and yield appreciation.” She expects that actual property shares will proceed to rise steadily.

Monetary shares, although, have been extra risky. Their current rise resulted from President Biden’s new spherical of sanctions on Russia. “Monetary shares will proceed to be risky,” Mkrtchyan stated. “However for now, I anticipate that they are going to proceed to rise.”

She additionally sees potential for “monumental cryptocurrency positive factors” as the worth of the ruble declines and extra individuals flip to crypto.

Among the standout shares within the monetary sector are: Financial institution of America (BAC +6.3%), Wells Fargo (WFC +5.8%), Fifth Third Bancorp (FITB +6.6%), State Road (STT +5.3%), Deutsche Financial institution (DB +6.2%), Brighthouse Monetary (BHF +5.7%), and Blackstone (BX +6.9%). Block (SQ +11.2%) advantages as each a monetary and a crypto inventory.

In the actual property area, the strongest gainers had been amongst tech-focused names: Opendoor Applied sciences (OPEN +10.3%), Compass (COMP +10.0%), eXp World (EXPI +7.4%), and Zillow (Z +7.2%). Some REITs additionally turned in robust performances: workplace REITs Kilroy Realty (KRC +2.9%) and Vornado Realty Belief (VNO +3.7%), digital-focused REIT DigitalBridge (DBRG +5.0%), resort REITs Ashford Hospitality Belief (AHT +7.5%) and Service Properties Belief (SVC +7.1%), and jail REIT CoreCivic (CXW +6.2%).

Cryptocurrency-related shares additionally surged right this moment after President Biden tells federal companies to look at the potential advantages and dangers of digital belongings